Tax Credit for Seniors and their Caregivers – What You Need to Know

Each year, filing tax returns (both federal and provincial) raises many questions to older adults living with physical or mental disabilities and to their loved ones. As a senior or a caregiver, you may be eligible for many credits and benefits. Here are some of the most relevant credits, deductions, or benefits.

Federal

1. Medical expenses

You can claim the medical expense tax for eligible expenses that you or your spouse paid. With a prescription, these costs can be: walking aids, hearing aids, compression stockings, fees paid to a healthcare professional to complete Form T2201, Certificate for the Disability Tax Credit, disposable diapers, dentures and implants, amounts paid to modify the home of a person who has a severe and prolonged motor impairment (modifications that allow them to access their home, to move around more easily, or to carry out their activities more easily; devices or equipment designed to help a person to get in and out of a bath/shower, or to sit on and stand up from the toilet).

Attendant care fees, prescriptions or prescription drugs, premiums paid to a private health insurance plan, dental care, vehicle transformation, vaccines, and glasses are also a few of the eligible expenses. Find an exhaustive list of eligible expenses here.

2. Disability tax credit (DTC)

If you have a severe and prolonged impairment in physical or mental function, you may be eligible for the DTC. A disability is severe when its effects are important enough that a person’s ability to perform daily activities is significantly limited. Remember that if you are claiming a deduction or credit for the first time for people with disabilities, you must produce a certificate from a doctor or health care professional (Certificate for the Disability Tax Credit – Form T2201).

3. Home accessibility tax credit.

This non-refundable credit (15% of an expenditure amount not exceeding $ 10,000) can be claimed in respect to expenses incurred to carry out renovations or modifications to make a home more accessible to a person aged 65 and over or to a person with a disability. This credit can be claimed by the person or their spouse, or by a family member who has asked (or may request) the caregiver amount or the amount for dependents 18 years of age or older who have a deficiency.

Provincial

For tax information for seniors in other provinces of Canada, see the links at the end of the article.

Provincial – Province of Québec

1. Amount for severe and prolonged impairment

You can claim this credit if you or your loved one has a severe and prolonged impairment in mental or physical functions, as certified by a doctor or, depending on the case, by another healthcare professional. Ask your healthcare professional for the Certificate of Impairment.

2. Amount for medical expenses

With a few exceptions, you can claim the tax credit for medical expenses for the same eligible expenses that you claimed at the federal level.

3. The refundable tax credit for home-support services for seniors

This credit’s objective is to help older adults stay in their homes for as long as possible. It reduces the costs of certain home support services – personal assistance services (dressing, hygiene, nurses, meal preparation, remote monitoring, and GPS tracking service, etc.) and maintenance services (housekeeping, exterior maintenance work, etc.). Note that the purchase or rental of monitoring equipment does not qualify for this credit but can be claimed for the refundable tax credit for expenses incurred by an elderly to maintain his independence (see below). However, you cannot claim expenses that you claim as medical expenses and vice versa.

4. The refundable tax credit for expenses incurred by a senior to maintain their independence

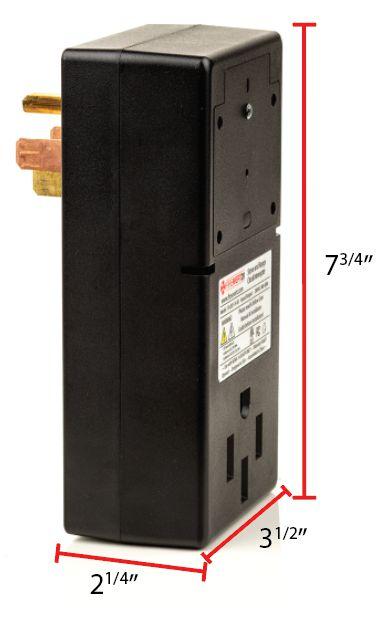

The following expenses are eligible: for the purchase, rental, and installation of certain goods such as a remote monitoring or GPS tracking device, certain goods intended to facilitate the use of a toilet seat, a bathtub, or a shower, a device for going up and down the stairs, a warning system for the hearing impaired, a hearing aid, a walker, a rollator, a cane, crutches, a non-motorized wheelchair, and a hospital bed for which the older adult did not receive reimbursement.

5. Tax credit for seniors’ activities.

Seniors who register for physical, artistic, cultural, or recreational activities may be eligible for this credit. Enjoy them!

6. The senior assistance tax credit

This credit is automatically paid to any very low-income senior over the age of 70 who does not have to pay tax and who files a return. Varying from $ 203 to $ 406 (for a couple), this credit can be reduced depending on family income that exceeds the applicable threshold, i.e. $ 22,885 ($ 37,225 for a couple). This credit is automatically calculated and paid to anyone who files a tax return.

7. Tax credit for expenses incurred by an elder for stays in functional rehabilitation transition units

This credit is given to a person over 70 years old who has paid expenses for staying in a transitional rehabilitation unit and that these fees have not been reimbursed or given any other tax credit (maximum of 60 days).

Are you caring for an aging loved one or someone with a disability?

You too can benefit from tax credits.

For caregivers

Federal

1. Canadian caregiver credit

You can claim this credit if you support your spouse who is physically or mentally disabled or for another person if they are dependent on you. A person is considered your dependent if they count on you to regularly and systematically provide them with all or part of the basics of daily life, such as food, shelter, and clothing. You do not have to live with the dependent.

Provincial – Province of Quebec

1. Refundable tax credit for caregivers

This credit is for a person 1) living with an eligible loved one who is unable to live alone due to a severe and prolonged impairment, 2) accommodates an eligible loved one who is either disabled or elderly aged 70 and over, 3) takes care of their disabled spouse, at least 70 years of age, or 4) offers regular and constant assistance to an eligible loved one suffering from a severe and prolonged impairment (without necessarily the latter living with your loved one). Please note, you cannot claim this credit if another person is already claiming it.

2. Refundable tax credit for a caregiver’s pension

Apply for this credit if you are a caregiver and you paid for care services and supervision by a person (with a recognized diploma) for a loved one with a disability.

Keep in mind

This article is intended to be an overview of the tax measures for older adults and is not exhaustive. Preparing your tax returns (and those of your loved one) can be complex. To benefit from all the credits and deductions to which you are entitled, we you can call on tax professionals who can help you.

If you have a modest income and a simpler tax situation, volunteers from community organizations are also a resource to help you prepare your tax returns for free. Learn more here.

Relevant information for Seniors

- Revenu Québec – Seniors and Taxation

- Ontario – Seniors and Taxation

- Alberta – Seniors

- British-Colombia – Seniors

- Manitoba – Seniors

- New-Brunswick – Seniors

- Nova Scotia – Seniors

- Nunavut – Seniors

- Prince Edward Island – Seniors

- Saskatchewan – Seniors

- Newfoundland and Labrador – Seniors

- Canada – Seniors